There are several ways to invest in property and benefit from this major market. As well as shares and bonds, real estate is a method that many investors add to their portfolio for its diversification opportunities and multiple ways to help your money grow.

In this blog post, we will explore indirect ways of investing in property and how they differ from owning physical bricks and mortar, the opportunities they present, and any new regulations that may affect your property investment.

Why invest in property?

One of the key benefits of investing in property is diversification. Unlike the stock market, for example, which can fluctuate throughout the day, changes in the real estate market can take some time to come into effect, which could give investors the time to amend their investments and techniques if needed. For example, house prices may take several months to fall or rise, or new tax regulations may be introduced the following tax year.

Another aspect of property investing that many investors find appealing is the choice it offers. Investors can choose:

· The type of property to invest in

· Which tenants they rent to

· How much rent they charge

· How the property is managed

On top of the above, there’s also a choice between active and passive property investing, meaning that investors can buy physical property and rent it out to generate an income stream or invest indirectly via property bonds, for example. Many time-poor investors can also often buy physical property but outsource the admin of finding the right opportunity, the right tenants, and maintenance and repairs.

As well as rental income, the other main attraction that property investing can offer is capital growth (in the event that house prices rise). Looking at recent historical data, the annual house prices in the UK grew by 6.3% in January 2023 from the previous year.

Is property still a good investment?

Buy-to-lets have lost a lot of their appeal over the last few years with many new tax regulations having been introduced around property ownership. Also, inflation hikes in the last two years have caused higher borrowing costs, which has led to mortgage lending levels falling to their lowest this year since 2016 (excluding the pandemic period). However, there’s a silver lining as mortgage approvals rose to their highest level for three months with an increase of 3,900 between January and February this year.

While affordability may have dropped last year, many buyers are returning to the market, albeit cautiously, and while housing stocks remain unable to keep up with demand, property remains a favourable investment method for many, with attractive opportunities still on the horizon.

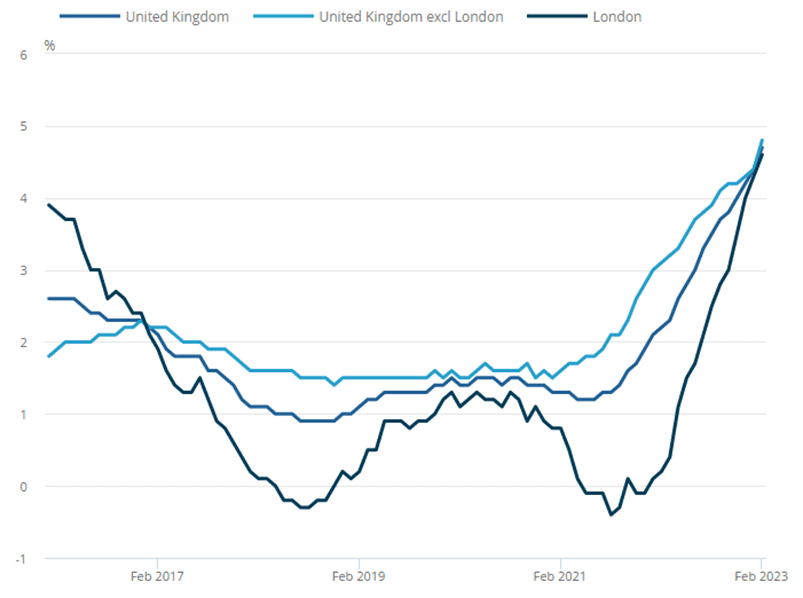

Despite house prices having experienced their largest fall in March since 2009, continuous rises in inflation mean that rents have been climbing. The below graph shows the annual private rental price percentage change in the UK:

Private rents in the UK grew by nearly 5% year on year to February 2023, which is an annual increase of over 4% and the largest annual percentage change since 2016. By region, East Midlands had the strongest annual percentage change in the same period, followed by the North West, South West, and London, and the weakest growth was seen in the West Midlands.

The above data shows that, even though house prices have fallen, the UK property market continues to thrive and present rewarding investment opportunities. Real estate is a resilient market and, despite occasional economic struggles, housing will stay in high demand.

How to invest in property without buying a house

Depending on your investment goals, buying physical property may not be a suitable route for you, but there are still many ways that you can benefit from exposure to the real estate sector.

One alternative to buying bricks and mortar is investing in Real Estate Investment Trusts (REITs). Investing in a REIT gives you a liquid stake in a range of properties including retail, commercial, and office spaces, which pays back a percentage of the income generated by those properties. As well as being a popular form of passive property investing, REITs can also offer capital return should your shares go up, and investors have the option to sell or buy quickly if they need to rather than waiting potentially several months to complete the sale or purchase of a physical property.

Another option is investing in residential property development projects. Whilst this method involves investing in physical houses, it still eliminates the management side of the process and remains a hand-off approach. These projects allow you to invest in new builds – often from the site acquisition stage – and once you’ve invested your capital, the developer simply continues with the construction and sales. The time horizons and rates of returns may differ between deals, however, so it’s always important to shop around and make sure you choose the conditions that are right for you.

You could also consider adding property to your portfolio in the form of bonds. You can invest in property bonds at a pre-agreed interest rate and your invested capital is used to fund a series of developments, which generate returns once completed and sold. There are many different bond options out there that are worth exploring, each with varying term times and interest rates. Some of the key benefits of property bonds are that they’re a passive investment method and the legally binding agreement of a bond means that your money is secured against the asset/s.

The Propiteer Capital Property Bond

If you’d like to invest in the property sector without buying physical bricks and mortar, there are several alternative ways of getting involved. If you think bonds are suitable for you, you could consider the Propiteer Capital Property Bond, which offers competitive fixed-rate returns on your investment in our diverse portfolio of Residential Properties, Branded Hotels, and Development Properties, which means you can diversify across property types, geographical locations, and investment type.

Propiteer Capital gives you the opportunity to grow your money easily through our unique, asset-backed projects, which secure your investment. Also, our flexible profit options enable you to choose how often you receive your profit, allowing you to easily plan your finances.

To find out more about our property bond, how we work, and how Propiteer Capital could suit your investment plans, visit our website or contact our team today on 01376 319 000.

Recommended Read: Common Myths and Misconceptions About Property Investing