Several factors could impact the UK’s most wealthy in 2023. One of the main contributors is the economic condition. A looming recession, sky-rocketing inflation, and currency fluctuations are just some of the influences that have continued into this year from 2022 that can affect investment returns, business profitability, and overall wealth.

Financial market volatility is another area that can have a key impact on wealth this year. The health of the global financial market in 2022 was unstable across the board. Raging inflation caused several asset classes to hit rock bottom and only a few managed to generate a positive return. Looking ahead at the remainder of 2023, it’s uncertain, to say the least as conflicting expert opinions paint a vague picture of the near future for the stock market.

Other factors that can impact your wealth this year are regulatory changes, technological disruption, political developments, and ESG (environmental, social, and governance) factors. In this post, we’ll examine each of these areas to highlight any potential risks to your wealth that they may have and recommend solutions to help keep your money protected.

Economic conditions

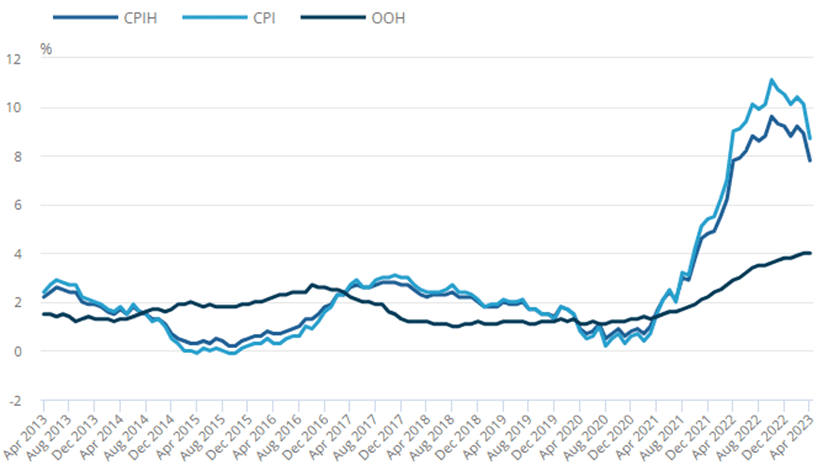

Despite initial forecasts, high inflation in the UK persisted well into 2023.

Although it has reduced since last March, the numbers remain shockingly high. In April, the Consumer Price Index (CPI) was 8.7%, down from 9% this time last year. Core inflation (excluding the key price drivers like energy, food, alcohol, and tobacco) has also accelerated from 6.2% in March 2022 to 6.8% this April. Pressure remains on the Bank of England as these numbers have surpassed all initial estimates as well as the 8.4% inflation rate that was anticipated, so interest rate hikes are expected to continue.

However, there may be a silver lining. While the above figures are exceptionally high, they have managed to fall into single digits for the first time in nearly one year. The BOE has also announced that it expects inflation to fall quickly in the remainder of 2023 for three reasons: wholesale energy prices have dropped, a sharp fall in the price of imported goods is predicted, and demand for goods and services is likely to decline as household budgets continue to be squeezed. The challenge that remains is to keep it low.

To restore economic health and reduce inflation to the 2% target, the BOE has been changing the base rate, which is currently 5%. While it initially poses higher borrowing costs, the full impact of rising rates takes between 18 months and 2 years to work. The aim is to drive up the price of borrowing and reduce consumer spending. Decreased demand should lead to slower price rises and, therefore, a lower rate of inflation, but despite the bank’s efforts, inflation remains at a stubbornly high level.

To protect yourself from economic disruptions this year, diversification can be a great place to start. A well-balanced, mixed portfolio can help mitigate unforeseen circumstances, ensuring that the majority of your investments stay protected if one asset class falls. Other useful strategies are staying informed about market trends and working closely with your financial advisors for guidance during uncertain times.

Financial market volatility

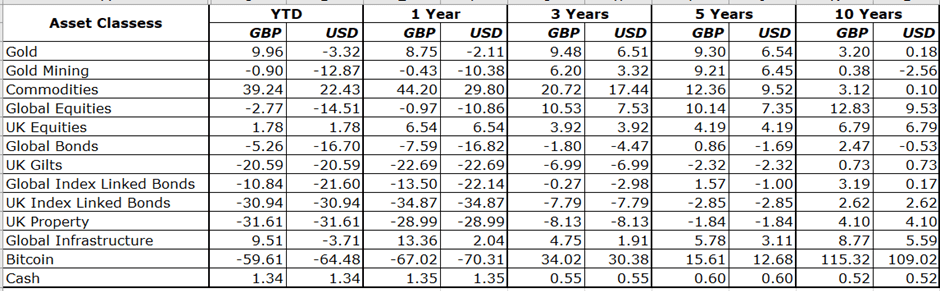

Stock market fluctuations are one of the main components of fluctuations within the overall financial market. The past 12 months have been shaky for the stock market and only a few asset classes grew in 2022.

Commodities (including natural resources and agricultural products) were the top-performing asset last year, which was driven by the price rise of “soft” commodities like grains, coffee, and livestock. It’s also the only asset to generate a double-digit return. Only one other asset ended the year with positive returns in US dollar terms, and in GBP, it was just two more.

The worst performer was Bitcoin, which crumbled under inflationary pressures and interest rate hikes as well as the collapse of the crypto exchange, FTX. This performance is a huge contrast to the crypto boom we saw during the pandemic.

Price swings are to be expected but as inflation remains unstable this year, it’s important to be cautious of the asset classes that have taken some of the worst hits under a looming recession and adjust your investments that best suits your risk attitude.

Regulatory Changes

There are several tax laws that investors should always be aware of, especially when the rules change, which can affect your wealth. Here are the main changes announced in the Spring Finance Bill 2023:

| Tax type | New regulations |

| Pension Tax | · The annual threshold allowance has increased from £40,000 to £60,000.· The minimum Tapered Annual Allowance (TAA) has increased from £4,000 to £10,000.· The income threshold for the TAA will increase from £240,000 to £260,000. |

| Income Tax | · The tax-free personal allowance for higher earners has dropped from £150,000 to £125,000. |

| Inheritance Tax | · Thresholds are frozen until 2028. |

| Capital Gains Tax | · Tax avoidance through share exchanges will be addressed.· The tax-free allowance has decreased from £12,300 to £6,000. |

| Dividend Tax | · The tax-free allowance has dropped from £2,000 to £1,000. |

| Corporation Tax | · The chargeable rates have changed to 19% on annual profits of up to £50,000 and 25% on annual profits of over £250,000. Marginal relief applies to those falling between the two. |

| VAT | · The VAT registration threshold is £85,000. |

| National Insurance | · The rate has dropped from 3.25% to 2% for those earning over £50,270. |

| Stamp Duty | · Regulations are frozen until 2025. |

A combination of factors including the 2022 mini-budget and inflation have resulted in a series of significant changes in the 2023/24 tax year. Some of the above allowance cuts pose substantial losses, so it’s always important to stay up to date with the latest regulations to make sure that your wealth accumulation and management are handled correctly.

Technical disruption

Advancements in technology can disrupt industries and business models, affecting the wealth of individuals in specific sectors. One of the latest AI advancements to dominate social and economic discussions is ChatGPT, a chatbot developed by OpenAI, whose founders include Elon Musk. ChatGPT passed one million users in under a week since it launched to the public in December 2022. The system is currently flawed in several areas such as producing factual and up-to-date information, but it’s also incredibly comprehensive. One concern that has emerged so far is job threat, with many people speculating about the likelihood of companies replacing certain roles with ChatGPT to streamline their business.

But ChatGPT isn’t the first AI revelation that humans have had. Over the years, studies have shown that AI could double annual global economic growth rates by 2035. Some researchers have also added that accelerating AI advancements could increase global GDP by up to 14% by 2030. On top of this, service and product enhancement, productivity, and efficiency are likely to surge with AI technologies, affecting sectors like manufacturing and transport.

However, there are some potential drawbacks. While AI could enable small companies to take on larger projects that are currently performed by big players, it could intensify competition and threaten mid-sized companies and diminish their role within their industry. Affordability is also called into question. Firms that adopt AI tools over the next few years could see significant benefits, but those who are unable to do so at the right time or at all could experience some economic decline.

There are many ways to navigate technological advancements in your industry. Staying attuned to trends, investing in innovation, and diversifying business interests can help mitigate risks associated with technological disruption.

Political developments

Some of the main effects of political developments on businesses and general wealth include an impact on the economy, changes in tax laws and regulations, political stability, and mitigation of risk.

Let’s look at Brexit as an example, the political and economic effects of which are still ongoing since the UK withdrew in early 2020. Stubborn inflation has been a ‘hot topic’ for a while now, but UK inflation has climbed faster than in the US and EU, and some experts say that Brexit plays a big part. Over 40% of our food is imported from the EU, and new import checks and border formalities have introduced higher costs for both consumers and businesses.

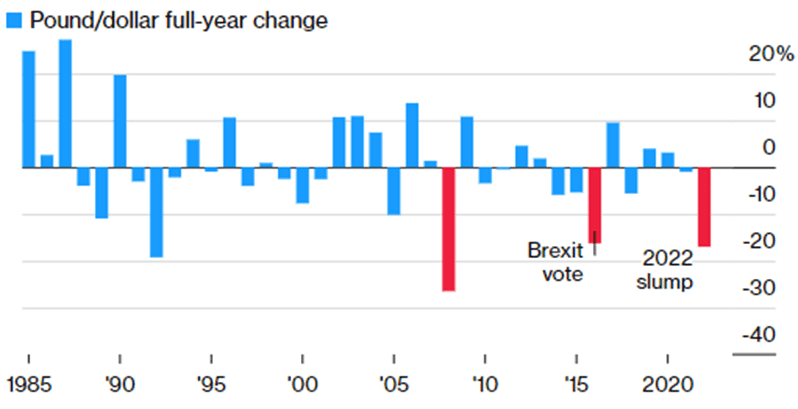

Another key area affected by political factors is the decline in sterling value.

The announcement of Brexit in 2016 depreciated the pound by -16.3% against the dollar. 2022, it plunged 17% after the mini budget was announced. This relates back to how economic conditions affect wealth – a weak pound eats into purchasing power, which means that rising costs make it increasingly challenging for business leaders to achieve profitable margins.

On the other hand, some areas like the stock market can benefit from a weak pound. For example, many big companies listed on the FTSE 100 make most of their profits overseas, making them more valuable when converted into pounds.

In these fluctuating conditions, monitoring political developments, engaging in advocacy, and adjusting wealth management strategies based on potential policy shifts can help protect wealth.

Social and environmental factors

Sustainable and environmental, social, and governance (ESG) investing has been a growing investment trend over the last decade. Here are some of the main ESG trends to keep an eye on in 2023:

1. Defining ESG

Some of the main terms used to describe ESG investing are ‘eco-friendly’, ‘sustainable’, and ‘responsible’, but the transparency of ESG investing is something that the growing trend has been called into question by the Financial Conduct Authority (FCA). In April 2023, the FCA published updated criteria for listed companies and regulated firms on sustainable finance as a way to protect investors, improve trust, and improve sustainable investment opportunities.

2. Standardised reporting

To make information more accessible and easier for investors to compare ESG investments, the 2022 Cop27 conference called for a clear and consistent way for companies to publish corporate sustainability reports.

3. Energy transition

Since the start of the energy crisis in 2021, energy transition is another key topic as governments and businesses all over the world pay more attention to reducing carbon emissions and switching to renewables. This could present new and exciting opportunities for investors in 2023 and beyond.

4. Supply chains examined

The pandemic brought to light just how interconnected and reliant businesses are on one another as supply chains all over the world were disrupted. This was intensified by the war in Ukraine. As a result, companies are likely to be put under the microscope to show their efforts to improve supply chains and mitigate risks while maintaining ESG values.

5. Improvements in carbon offsetting

The demand for carbon reduction initiatives is growing amongst consumers, investors, and businesses. It’s expected that the emphasis on this will continue as companies with an ESG focus streamline and improve their energy efficiency.

6. ESG practices are rising

The number of companies taking up ESG practices has been growing and is expected to continue to rise. As environmental health is increasingly brought to the forefront, both consumer and commercial demand is increasing for businesses to embrace ESG values.

How to protect your wealth in 2023 and beyond

Under any economic or environmental conditions, diversification is an excellent way to keep your assets protected. It’s impossible to mitigate all risks, particularly those that are unforeseen, so a well-balanced portfolio is one of the most effective ways to shield your wealth from any harsh impacts. It’s also beneficial to review your portfolio, business strategy, and financial plans regularly, allowing you to adjust to changing market conditions.

Other useful ways of protecting your wealth include staying informed and educated on economic and regulatory changes, engaging regularly with your financial advisors, focusing on long-term goals, adopting risk management strategies like insurance and hedging, supporting philanthropic causes, and building valuable relationships through networking and collaborating.

To keep your assets diverse and balanced, you may find the Propiteer Capital Property Bond useful. By aligning our business strategy with those of the wealthy, we know that there may be trouble ahead, but we are prepared. That’s why our development portfolio consists of a variety of property types and geographical locations, all of which are carefully selected by our board of partners to bring you high-quality, profitable property investment opportunities that have the potential to be resilient against economic downturns.

To find out how Propiteer Capital can benefit your financial plans, get in touch with our team on 01376 319 000 or email info@propiteercapital.com.

Recommended Read: How to Build and Secure Wealth