Property is one of the most popular and successful investment methods that provide the opportunity to grow money over time. Depending on the approach and if done correctly, property can be a worthwhile investment that can offer returns in many forms such as value appreciation, rental income, and interest.

Among the many successes, however, lies the odd negative property investment story, which paves the way for misconceptions. In this post, we address some of the most common myths about real estate investing and answer a series of frequently asked questions to help you find a suitable property investing technique.

There is no money in property anymore

We may no longer see the property boom that the Covid-19 pandemic encouraged, but that doesn’t mean there’s no longer anything to gain from investing in real estate. Savvy investors that shop around, research, and consult their financial teams can still find the right opportunities in the right places.

While rising interest rates have been causing buyer demand to slow down over the last year and property prices to fall, there is positive news that market experts are not predicting a price crash. Online property agent Zoopla’s executive director, Richard Donnell, comments: “As we end the first quarter of 2023, the housing market is in much better shape than many predicted at the end of 2022 and there are no clear signs of a house price crash.” Even though sellers have been offering an average 4% discount amid growing borrowing costs, Donnell adds that buyers and sellers continue to agree on deals that are supporting the UK housing market.

Despite some industry experts expecting as much as a 10% drop in prices in 2023, property is a market that should be explored on a regional level as demand and conditions will vary all over the country. This means that sophisticated investors can continue to find suitable property investments on the back of thorough research. For example, existing or prospective landlords could find the right opportunities in servicing the rapidly growing demand for residential rents, or if you’re considering holiday lets, you could find attractive returns from short-term lets in flourishing seaside towns.

You need lots of money to invest in property

Depending on the investment method you choose, you don’t necessarily need a lot of money to get started in property. If you opt for a buy-to-let (whether that’s an outright purchase or via a mortgage), you’re likely to need a substantial amount to cover the deposit, stamp duty, and legal fees. However, if you choose to invest in property bonds, for example, this investment type excludes all the upfront costs that are involved when buying bricks and mortar.

You can get rich quickly with property investing

While it’s possible to buy a property and sell quickly for a profit, the reality is that most successful investors plan their property investment in detail, researching the most suitable strategy to make sure it aligns with their goals.

Typically, property is a long-term investment. The property market is reactive to general economic health, but those reactions can take longer to come to fruition than a more sporadic method like stocks. This means that house prices can take several years to rise (or fall) enough to generate a considerable profit.

Any property will do

Overall, property is seen as a stable and lucrative investment, but one myth about investing in this market is that any property you buy will work out to be worthwhile. Generally speaking, house prices and rents tend to increase over time, but there are plenty of other factors to take into account when looking for the right property investment.

There are many ways to invest in property other than buy-to-lets. If physical property isn’t for you, you may find Real Estate Investment Trusts (REITs), buy-to-sell developments, or bonds more suitable, but if you do decide to buy bricks and mortar, there are many property types to consider, each with their own pros and cons and prospective returns depending on the property type, location, and intent. You should also consider your own circumstances, investment plans, and risk tolerance before committing this can all impact the success of your investment.

House prices will always rise

A generic view of historical data may show that house prices rise over time, and while that may be true, past performance is not a reliable source to base your investment decisions on.

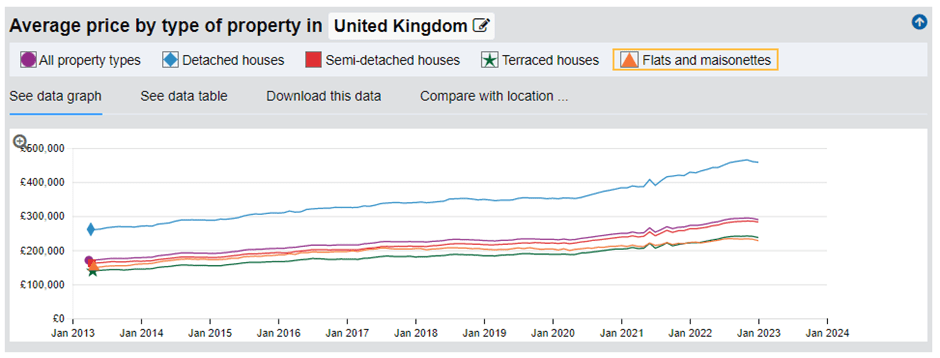

The below graph shows the average property price in the UK over the last 10 years.

We can see that, generally, house prices have been on an upward trend since 2013 and, in that time, prices have increased by over 70%, but there are several variables that a more granular view of the above performance could show very different results. Here is a more detailed view:

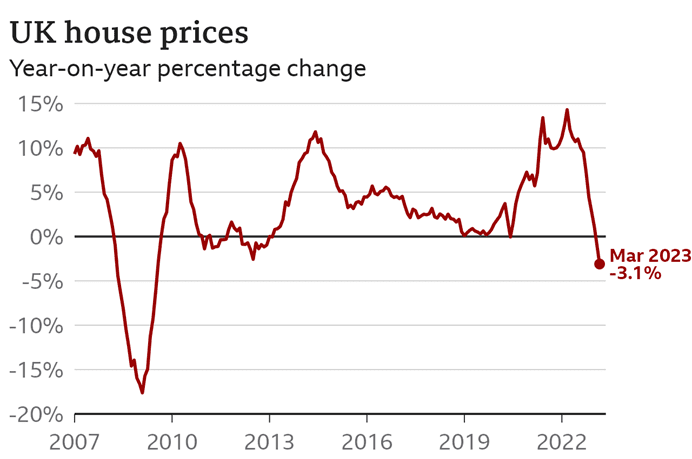

One major variable when looking at historic data is the time frame. By taking a closer look, we can see where and how prices have been impacted significantly in the past, such as 2020-2021 when prices took a steep incline due to growing demand fuelled by the pandemic. Going back a bit further, we can see that the financial crisis in 2009 meant that UK property prices plunged by nearly 20% but didn’t take too long to start to recover.

A more recent example is the housing market’s “biggest annual fall since 2009”. As a result of dramatic inflation and interest rate hikes over the past year, UK house prices have seen their fastest annual decline in the last 14 years, with Nationwide revealing that prices were down 3.1% from March 2021.

This means that it’s useful to look at past performance, but it should only be used to gain a general understanding of market health. The impact on your returns from a property investment relies on additional factors like timing and property type.

It’s all about capital growth

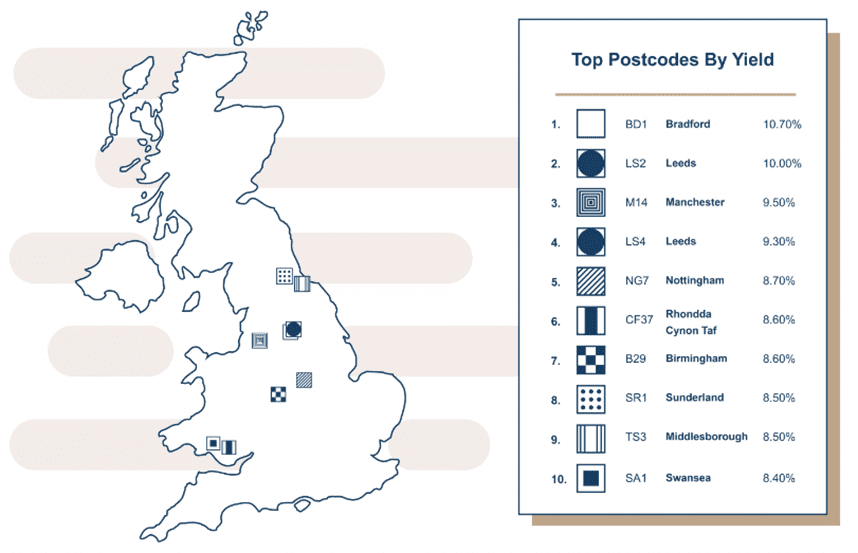

One of the main advantages of property investing is capital growth, but short-term income is also important. If you’re interested in rental properties, they have the potential to generate a regular income through rent as well as value appreciation when you sell. Rental yield can vary across regions, demand, property type, and the facilities you’re able to offer as a landlord, such as a garden, can impact your prospective profits, too.

The below map shows the top UK postcodes by rental yield for 2023:

Bradford has climbed the ranks since 2022 from third place to the highest renal yield in the UK. Nottingham was last year’s top spot, which has now been knocked down to fifth place with rental yield dropping from 11.3% to 8.7%.

The rental market is congested

This may be the case, but several market forces will have a huge impact on this. For example, short-term lets have become increasingly popular in the last few years. Online hosting platform, Airbnb, reveals that their listings jumped by 17% year-on-year in the last quarter of 2022, and over half of their global online listings were added only in the last three years. As a result of last year’s low mortgage rates, many investors seized the opportunity and have listed their new properties as short-term rentals, but competition has grown and some holiday homes in particularly saturated areas have become mid-term rentals to help maximse returns.

But investment opportunities within the rental market remain. In fact, demand for UK rental homes jumped by 23% since this time last year. This comes from house prices dropping to new lows and rents hitting a record high, which means that demand for rental properties continues, leaving many exciting investment options on the table. One way to avoid saturation is to opt for one of the best-performing regions for rental yields, like Manchester or Leeds, as opposed to the top one, which still offers significant returns whilst evading the potential rush towards Bradford.

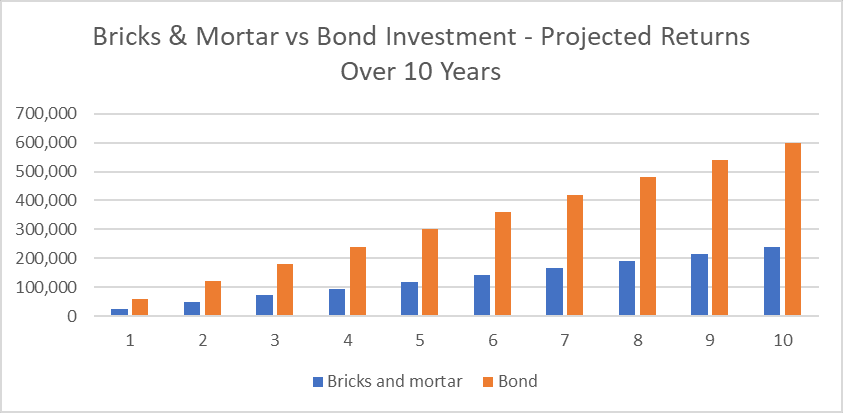

Bonds don’t deliver the same returns as bricks and mortar investments

With the average rental yield in the UK for 2023 of 4.75% in mind, the below table shows the estimated capital returns from a bricks and mortar investment compared to a 12% bond over a 10-year period.

The above example is based on the cash purchase of a £500,000 house and renting it to tenants over 10 years versus a £500,000 cash investment in a 12% bond. It also assumes that house prices will increase by an ambitious 70% in that time. What we can see is that a 10-year hassle-free bond investment that avoids house price fluctuations has the potential to generate £1.1m in capital returns. On the other hand, if you invest in property, your return could be £1.08m.

How to get started in property bonds

If you’re looking for your next property investment and bonds are of interest to you, you could consider the Propiteer Capital Property Bond. Our bond gives investors exposure to three core asset classes, including residential properties, branded hotels, and development properties.

With Propiteer Capital, you can easily grow your money by investing in our unique portfolio of desirable, asset-backed projects. At the same time, your funds are spread across our diverse property development portfolio, and with flexible payment options, you can easily plan your finances and choose how often you receive your returns.

To find out more about our projects, take a look at our case studies, or get in touch with our team today to find out more about us, our bond, and how it could benefit your investment plans.

Recommended Read: Property Investing: The Ultimate Guide