Real estate is one of the most popular investment methods. From residential buy-to-lets and stocks to commercial property and bonds, there are many different ways to gain exposure to this market and take advantage of its many benefits.

In this blog post, we’ll take you through everything you need to know about property investing including how the market has performed historically, its pros and cons, and various investment options that you could consider adding to your portfolio.

Why invest in property?

One of the most popular reasons to invest in property is because it offers a comparatively low risk. While other investment types like stocks or cryptocurrencies could present higher rewards, they can often come with higher risks. For investors who are more risk-averse, property investing conveniently bridges the gap between risk and reward with the ability to offer an asset-backed investment with lucrative returns.

Property can also be considered a slow and stable investment. While this market, like others, is affected by economic downturns, those effects may not be as sudden as stocks, for example, which can rise or fall in value dramatically in a matter of minutes.

Real estate investing can also be flexible, with several options to consider depending on how active an investment you are looking for. If you’d like to own physical property, a buy-to-let can generate a healthy rental income and offer the added benefit of potential value appreciation when you sell, as well as the utility from living in the property yourself. However, if managing physical property isn’t for you, there are other passive investment methods like property bonds that generate returns from interest.

Real estate stocks

Some investors prefer to invest in real estate stocks over residential buy-to-lets (BTLs). This means they own a percentage of the shares in a company that owns properties, and their income is drawn from the rent. This way, investors can avoid additional expenditures like conveyancing fees, stamp duty charges, and repairs that can eat into their profits when buying bricks and mortar.

On the other hand, as these companies are listed on exchanges, the value of their stocks can change on a daily basis. However, they are asset-backed, and the relatively stable value of the properties that these companies own adds security to investors’ funds. This as well as property being a tangible asset could mean that investors are less likely to sell their property stocks during market instability in comparison to tech companies, for example.

How has property performed?

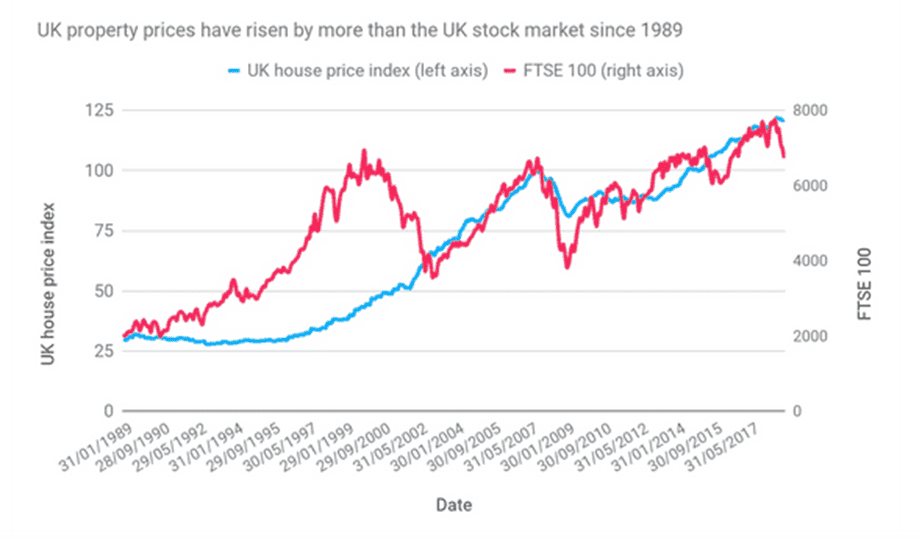

Minus the occasional dip, property prices have been on a steady rise in the UK over the last few decades. Here’s how annual house prices have performed in the past against the stock market:

Depending on the timeframe, you may get different results, but if we compare the entirety of the above, we’ll see that UK house prices have risen 308% between 1989 and 2017 versus the 228% growth of the stock market in the same period.

If we narrow down the timescale, however, we’ll see that, in the early 2000s, the dotcom bubble burst caused investor overconfidence to come crashing down, making house prices the clear outperformer. Then, just under a decade later, the global financial crisis caused market falls across the board, but house prices still proved to be the more lucrative investment. However, in 2014, the tables started to turn as the returns from property were overtaken by stocks.

From the above trends, we can gather that, generally, property prices tend to rise steadily over time while the stock market can be more sporadic. But while past data can be a good performance indicator, it only offers a generic overview and may not form an accurate basis for future investment decisions.

How can you invest in property?

When thinking of property investing, the first method that likely comes to mind is buy-to-let, but while becoming a landlord still offers many benefits, there are several alternative ways to add property to your portfolio that could be valuable.

1. Single let residential property

Single lets are one of the most traditional property investing strategies and possibly the most straightforward. Whether you choose to rent your property to a single tenant or a family, single lets can offer:

· Rental income – During occupancy, landlords can earn a steady rental income, which reached an all-time high of £1,184 PCM in March 2023 – that’s nearly a 10% increase from the previous month.

· Value appreciation – Despite the Covid-19 pandemic and recent price falls, the average property value has continued to rise, with a 6.3% increase in the 12 months to January 2023. At the start of the year, the average house price was £289,818, up from £272,739 the previous year.

Pros

· Residential property tends to stay in high demand.

· Offers the opportunity for consistent rental income with high rental yields across the UK.

· Offers two types of returns: rental and capital growth.

· Option to hire a rental management company for a hands-off investment.

Cons

· It is generally a long-term investment, so this may not be suitable for short-term gains.

· Potential void periods between tenants.

· Additional expenditures such as stamp duty and regular maintenance to consider.

2. Purpose-built student accommodation

Student housing has become an increasingly popular property investment in the last few years. Similar to buy-to-lets, landlords rent purpose-built homes exclusively to student tenants.

University applications in the UK have been on the rise, which has been fuelling the demand for student housing. In 2022, UCAS reported more than a 3% increase in university applications versus the year before – the highest number of students opting for higher education on record.

Pros

· Offers a combination of rental income and capital growth.

· Rental demand is likely to be consistent with the rise of university students in the UK.

Cons

· Capital growth of student housing may be lower than residential buy-to-lets.

· Limited to one demographic.

3. HMOs

Houses in multiple occupation are a form of buy-to-let where a property is shared by multiple tenants, each paying rent per room and sharing communal facilities like the kitchen and bathroom.

HMOs tend to be popular amongst students and young professionals who find HMOs appealing for reasons like affordability, convenience, and sociability. For investors, HMOs offer benefits like attractive profitability in the right location and recession-proof prospects.

Pros

· Generate income from multiple tenants.

· Multiple tenants can offer a safety net if one tenant stops paying rent.

· Can offer recession-proof potential during times when tenants are more likely to share the cost of renting a property.

Cons

· HMOs can come with more complex tax rules.

· It can be difficult to secure a mortgage for HMOs.

· Multiple occupancies could mean more tenant and property management.

4. Property developments

Property developments (also known as buy-to-sell or house flipping) are one of the most popular non-traditional investing strategies that involve buying a property in need of refurbishment and renovating it to boost its value and sell for a profit.

Unlike traditional buy-to-lets, property development investing doesn’t rely on tenants for a regular income and doesn’t involve ongoing property management. Instead, investors can choose a suitable market and location that meets their needs and generate a profit from the sale of improved property.

Due to high inflation and rising rates over the last year or so, we’ve been seeing UK property prices fall to new lows and buyer demand slowing as people remain cautious of higher mortgage repayments and tightened budgets. However, savvy investors interested in property developments could be able to find the right opportunity in the right places. Online property platform, Zoopla, announced that Liverpool is the fastest-moving property market in the UK, followed by cities like Birmingham, Manchester, Newcastle, and Bristol.

Pros

· Potential to generate a substantial profit from the right property renovations.

· Avoids the need to find or manage tenants.

· Avoids potential void periods.

· Potential to buy property at low cost.

Cons

· A very hands-on project if investors carry out the renovations themselves.

· Can be a costly investment depending on the level of work needed.

· Potential of profit loss if the renovations are not up to standard or the property isn’t chosen correctly.

5. Holiday lets

Similar to traditional buy-to-lets, holiday lets mean buying a property and renting it out for income. The main difference is that holiday lets are used for short periods of time, primarily for holidays and short stays. These can be either in the UK or abroad.

Holiday lets could be a worthwhile investment to explore considering the flourishing staycation market in the UK since the Covid-19 pandemic that could be set to continue for a while.

Pros

· Potential for attractive rental income for the right property in the right location.

· Several tax benefits.

· Avoids the need to actively search for and manage tenants.

Cons

· Can be high maintenance with cleaning, updating, managing, and marketing the property.

· Potentially lengthy void periods.

· Depending on the location and demand, this could be a seasonal investment.

6. Commercial property

Many high-net-worth investors opt for commercial property, which means buying an office or retail space, for example, and renting it out to companies and business owners.

Commercial property is more suitable for long-term leasing as opposed to selling, which could make it easier to secure long-term, regular cash flow.

Pros

· Longer lease lengths could secure a long-term, consistent income source.

· Building management could be more flexible than traditional buy-to-lets.

· Could generate a large profit when sold.

· Offers several tax advantages.

Cons

· Void periods could be lengthy.

· Mortgages for commercial buy-to-lets could be quite costly compared to residential.

· Commercial property can particularly suffer during times of economic uncertainty.

7. Bonds

Many investors choose bonds as an indirect property investment. Unlike many other methods, bonds offer a pre-agreed fixed rate of return and regular payments, and the invested funds are used to finance a variety of property projects. Property bonds are also usually asset-backed, giving security to your investment.

Pros

· Diversification opportunities by investing in a pool of projects.

· Invest at pre-agreed terms.

· Bonds are typically fixed-rate.

Cons

· Rates could be low under unstable market conditions.

· Can involve locking funds away for the long term.

Benefit from property bonds with Propiteer Capital

If you’d like to get started in property through bonds, Propiteer Capital could be a suitable fit. With the Propiteer Capital Property Bond, you’ll find competitive fixed rate returns to help grow your money through exposure to three core asset classes: residential properties, branded hotels, and development properties. All our assets are built on market data to bring you access to high-quality homes and hotels in robust and profitable locations across the UK and Ireland.

We secure your funds against asset-backed projects, providing security against your investment, and with flexible payment options, you can easily plan your finances.

Our bond also allows you to invest in our diverse pool of property developments including a variety of luxury homes, high-end apartments, and world-class branded hotels, so you can easily diversify your portfolio.

To find out more about our property bond and how it could help you get started in property, visit our website or give our team a call on 01376 319 000.

Recommended Read: Keeping Fit to Stay Wealthy